Global uncertainty and financial market volatility tend to enhance the attractiveness of hard assets in relatively stable markets. But that doesn’t appear to be the case for Hamptons luxury real estate. The facts are quite clear, the market is soft. Here are just a few of the depressing quotes we pulled from articles around the web:

“The end of 2016 was an ugly one for real estate in the East End.” – New York Post

“Sellers of Hamptons mansions are having to slash prices to secure sales as the glitzy summer hot spot’s luxury housing market continues to cool.” Mansion Global

Is there light at the end of the tunnel or is it all doom and gloom?

Well, it probably depends on who you sit down and ask:

If you ask an investment company who seeks a healthy return secured by real estate, you may hear they committed capital to just 3 Hamptons projects in 2016 as opposed to 7 projects the year prior.

If you’re speaking with a broker whose commission depends on your being bullish on the market, you’ll hear unbridled enthusiasm and optimism.

If you ask an end user who just picked up a steal of a deal on their dream house they may invite you inside for a tour that never seems to end.

If you ask a builder who’s high end spec project has been sitting on the market through multiples sales cycles, you’re likely to hear an inaudible moan.

Perhaps you remember a few years ago when the New York Times dropped this gem of a quote:

“In the Hamptons, where million-dollar vacation homes are snapped up like flea-market finds and $10 million spec homes are in such high demand that their developers could moonlight as fortunetellers were they not so busy building more, buying new has become not only the fashion but the first choice. Buying vintage tends to spawn repair and renovation headaches; choosing turnkey promises convenience and five-star amenities. To find appropriate settings for new construction, tearing down an old house, far from being vilified, is standard operating procedure as land grows ever scarcer and more expensive.” – New York Times

That may have been true a few years ago, but we seem to be living in a different climate now.

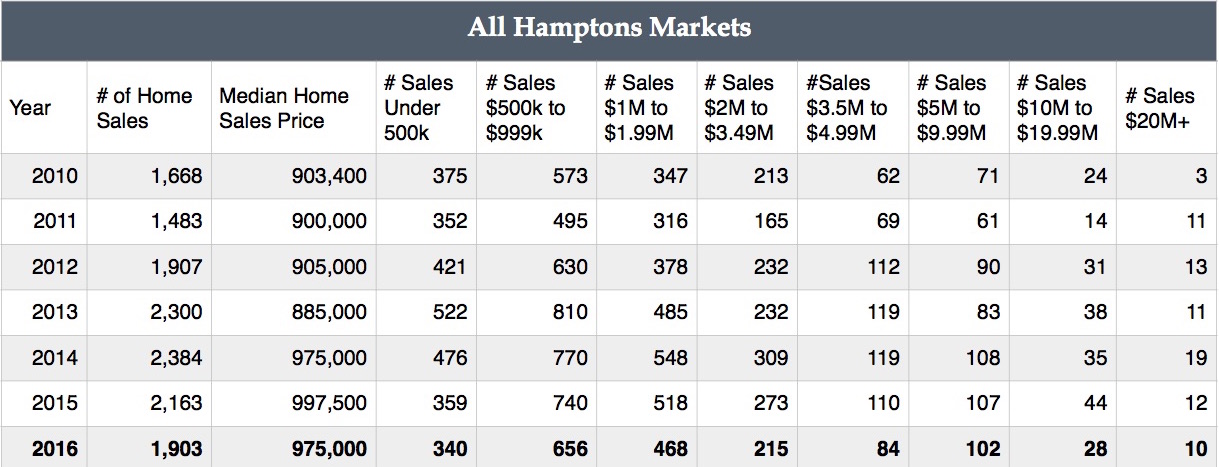

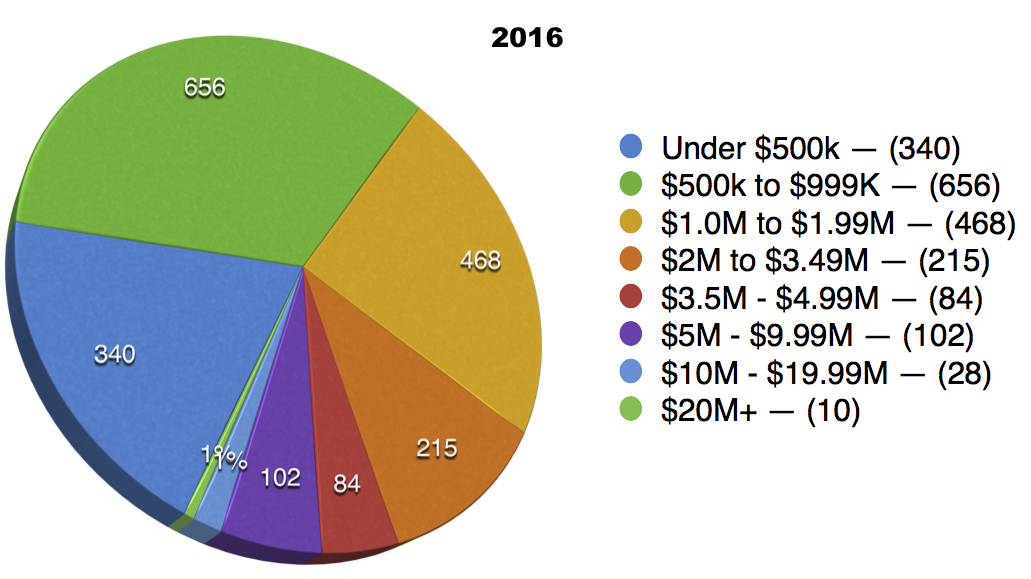

Year-over-year numbers have taken a hit:

As consultants, we keep an eye on market trends in order to develop strategies to avoid and reduce any negative effects market volatility may have on our builder client’s operations and investors.

Contrary to the New York Times quoted above, the Hamptons ultra high-end segment of market will likely continue to see slower turnover rates due to increased supply and lower demand. The safest segment of the market to deploy capital is in our opinion the most active segment of the market. For example; projects with selling prices between $1.0M and $3.0M. Buyers who can’t afford to purchase a home in the $3.0M to $5.0M range naturally go searching for something more conservative but with all the same amenities they would hope to find in a larger luxury home.

We suggest speculators take another look at their business model and come up with strategies to reduce risk. One such way is to pursue development partnerships with land owners who’s land has been sitting on the market for a while. It’s a lot easier to sell a piece of dirt if you put a house on it. At the time of writing this, HRP, our consulting arm is currently working on $27MM worth of land partnerships between owners and builders.

The benefit to the builder is the ability to launch a spec project with a lessor capital expense, thus leaving any investors less exposed.

An owner can be motivated by a full priced sale, and the possibility of added income from interest earned during the development or re-development period, and a share of the profits. Oftentimes, a joint venture is an Owners only route to achieving a full asking price.

Projects that have special characteristics such as waterfront, or water views are always in vogue and decrease the chance you’ll have a spec project sitting on the market too long.